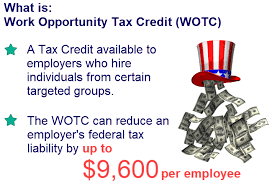

Work Opportunity Tax Credit

Work Opportunity Tax Credit is a tax credit to employers when they hire individuals in Target Groups like Veterans, Ex-Felons, Summer Youth Programs.

The Work Opportunity Tax Credit (WOTC) is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment.

WOTC joins other workforce programs that incentivize workplace diversity and facilitate access to good jobs for American workers.

The Protecting Americans from Tax Hikes Act of 2015 (the PATH Act) retroactively allows eligible employers to claim the Work Opportunity Tax Credit (WOTC) for all targeted group employee categories that were in effect before the enactment of the PATH Act, if the individual began or begins work for the employer after December 31, 2014, and before January 1, 2021. For tax-exempt employers, the PATH Act retroactively allows them to claim the WOTC for qualified veterans who begin work for the employer after December 31, 2014, and before January 1, 2021. The PATH Act also added a new targeted group category to include qualified long-term unemployment recipients.

Targeted Groups

Employers can hire eligible employees from the following target groups for WOTC.

Qualified IV-A Recipient

An individual who is a member of a family receiving assistance under a State plan approved under part A of title IV of the Social Security Act relating to Temporary Assistance for Needy Families (TANF). The assistance must be received for any 9 months during the 18 months ending on the hiring date.

Qualified Veteran

A “qualified veteran” is a veteran who is any of the following:

- A member of a family receiving assistance under the Supplemental Nutrition Assistance Program (SNAP) (food stamps) for at least 3 months during the first 15 months of employment.

- Unemployed for a period totaling at least 4 weeks (whether or not consecutive) but less than 6 months in the 1 year ending on the hiring date.

- Unemployed for a period totaling at least 6 months (whether or not consecutive) in the 1 year ending on the hiring date.

- A disabled veteran entitled to compensation for a service-connected disability hired not more than one year after being discharged or released from active duty in the U.S. Armed Forces.

- A disabled veteran entitled to compensation for a service-connected disability who is unemployed for a period totaling at least six months (whether or not consecutive) in the one year ending on the hiring date.

See IRS Notice 2012-13 PDF for more detailed information.

Ex-Felon

A “qualified ex-felon” is a person hired within a year of:

- Being convicted of a felony or

- Being released from prison from the felony

Designated Community Resident (DCR)

A DCR is an individual who, on the date of hire

- Is at least 18 years old and under 40,

- Resides within one of the following:

- An Empowerment zone

- An Enterprise community

- A Renewal community

- AND continues to reside at the locations after employment.

Vocational Rehabilitation Referral

A “vocational rehabilitation referral” is a person who has a physical or mental disability and has been referred to the employer while receiving or upon completion of rehabilitative services according to:

- A state plan approved under the Rehabilitation Act of 1973 OR

- An Employment Network Plan under the Ticket to Work program, OR

- A program carried out under the Department of Veteran Affairs.

Summer Youth Employee

A Work Opportunity Tax Credit “qualified summer youth employee” is one who:

- Is at least 16 years old, but under 18 on the date of hire or on May 1, whichever is later, AND

- Is only employed between May 1 and September 15 (was not employed before May 1st) AND

- Resides in an Empowerment Zone (EZ), enterprise community, or renewal community.

Supplemental Nutrition Assistance Program (SNAP) Resident

A “qualified SNAP benefits recipient” is an individual who on the date of hire is:

- At least 18 years old and under 40, AND

- A member of a family that received SNAP benefits for:

- the previous 6 months OR

- at least 3 of the previous 5 months.

Supplemental Security Income (SSI) Resident

An individual is a “qualified SSI recipient” if a month for which this person received SSI benefits is within 60 days of the date this person is hired.

Long-Term Family Assistance Recipient

A “long term family recipient” is an individual who at the time of hiring is a member of a family that meets one of the following conditions:

- Received assistance under an IV-A program for a minimum of the prior 18 consecutive months; OR

- Received assistance for 18 months beginning after 8/5/1997 and it has not been more than 2 years since the end of the earliest of such 18-month period; OR

- Ceased to be eligible for such assistance because a Federal or State law limited the maximum time those payments could be made, and it has been not more than 2 years since the cessation.

Work Opportunity Tax Credit Long-Term Unemployment Recipient

A qualified long-term unemployment recipient is one who has been unemployed for not less than 27 consecutive weeks at the time of hiring and received unemployment compensation during some or all of the unemployment period.

Pre-screening and Certification

An employer must obtain certification that an individual is a member of the targeted group, before the employer may claim the credit. An eligible employer must file Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit, with their respective state workforce agency within 28 days after the eligible worker begins work.

Employers should contact their state workforce agency with any specific processing questions for Forms 8850.

Limitations on the Credits

The credit is limited to the amount of the business income tax liability or social security tax owed.

A taxable business may apply for the credit against its business income tax liability, and the normal carry-back and carry-forward rules apply. See the instructions for Form 3800, General Business Credit, for more details.

For qualified tax-exempt organizations, the credit is limited to the amount of employer social security tax owed on wages paid to all employees for the period the credit is claimed.

Claiming the Work Opportunity Tax Credit

Qualified tax-exempt organizations will claim the credit on Form 5884-C, Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans, as a credit against the employer’s share of Social Security tax. The credit will not affect the employer’s Social Security tax liability reported on the organization’s employment tax return.

Taxable Employers

After the required certification is secured, taxable employers claim the tax credit as a general business credit on Form 3800 against their income tax by filing the following:

- Form 5884 (with instructions)

- Form 3800 (with instructions)

- Your business’s related income tax return and instructions (i.e., Forms 1040 or 1040-SR, 1041, 1120, etc.)

Tax-exempt Employers

Qualified tax-exempt organizations described in IRC Section 501(c) and exempt from taxation under IRC Section 501(a), may claim the credit for qualified veterans who begin work on or after December 31, 2014, and before January 1, 2021.

After the required certification (Form 8850) is secured, tax-exempt employers claim the credit against the employer’s social security tax by separately filing Form 5884-C, Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans.

File Form 5884-C after filing the related employment tax return for the period that the credit is claimed. The IRS recommends that qualified tax-exempt employers do not reduce their required deposits in anticipation of any credit. The credit will not affect the employer’s Social Security tax liability reported on the organization’s employment tax return.

Work Opportunity Tax Credit

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Blog » Accountants in Miami » Work Opportunity Tax Credit