Agreed Upon Procedure

Agreed Upon Procedure performing a specific test or business process. For example, Procedures may be developed when considering purchasing a business.

A CPA can offer many types of helpful Agreed Upon Procedure for audit and assurance services for businesses. An audit, for instance, is a common type of attestation service that provides a formal opinion about whether a company’s financial statements conform to U.S. Generally Accepted Accounting Principles (GAAP).

Consulting services, in contrast, may include advice or technical assistance that’s only for the business’s Agreed Upon Procedure (AUP) internal purposes. As such, lenders and other third parties can’t rely on the findings, conclusions, and recommendations presented during a consulting project.

When you need a report that falls somewhere between audits and consulting services, consider an Agreed Upon Procedures engagement.

Scope of Agreed Upon Procedure

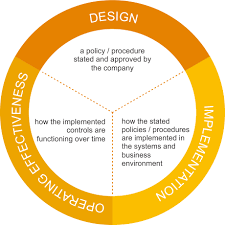

An (AUP) engagement uses procedures similar to an audit, but on a limited scale. It can be used to identify specific problems that require immediate action. When performing an Agreed Upon Procedure engagement, your CPA makes no formal opinion; he or she simply acts as a fact finder. The report lists:

The procedures performed, and The CPA’s findings.

It’s the user’s responsibility to draw conclusions based on those findings. Agreed Upon Procedure engagements may target specific financial data (such as accounts payable, accounts receivable or related party transactions), nonfinancial information (such as a review of internal controls or compliance with royalty agreements), a specific financial statement (such as the income statement or balance sheet) or even a complete set of financial statements.

Advantages

Agreed Upon Procedure engagements have several advantages. They can be performed at any time during the year and they can be relied on by third parties. You also have the flexibility to choose only those procedures you feel are necessary, so (AUP) engagements can be cost-effective.

Specifically, AUP engagements can be useful in these situations:

M&A due diligence

When a business owner suspects an employee of misrepresenting financial results, and

To determine compliance with specific regulatory requirements, such as the Health Insurance Portability and Accountability Act (HIPAA) or the Federal Information Security Management Act (FISMA).

In addition, lenders or franchisors may request an A(AUP) engagement if they have doubts or questions about a company’s financials or the effectiveness of its internal controls — or if they want to check on the progress of a distressed company’s turnaround plan.

Agreed-Upon Procedure

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Accounting & Bookkeeping Services » Agreed Upon Procedure