What Accountants Knew All Along

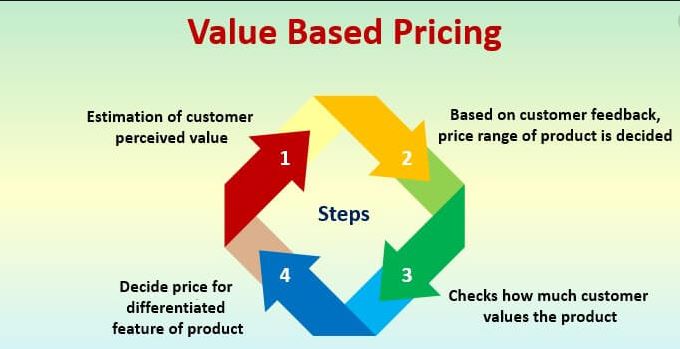

What Accountants Knew All Along About Fixed Fee Value Pricing. Value pricing is about pricing the CUSTOMER, not the SERVICE.

Value pricing, also known as fixed-fee billing, is attractive on some levels to both Accounting Firms and their clients: because they get their fee upfront, normally at a premium above their time-based billing; and clients, because it provides them with certainty about the services they will receive and the fee they will be billed.

Our Accounting Firm has known this all along and we put it in writing for everything we do.

“They don’t feel they’re being nickeled and dimed to death every time they call with a question,” said Gustavo A Viera, managing partner in a Miami Accounting Firm.

Yet most Accountants are reluctant to actually go ahead and convert their practice into a value billing one. “A value-pricing agreement, tied in with an engagement letter, defines the engagement terms prior to starting work, and enhances client perception of the Accountant value”, said Gustavo Viera”.

“Clients know exactly what we are providing and how much it will cost upfront,” he said. Our Accounting Firm knows exactly which services need to be done for the client—each line on the value-pricing agreement becomes a task to be completed on our Miami Accounting Firm’s practice management software.

As an Accounting Firm, I switched to value pricing 20 years ago as I met each client individually to explain the new system. “Your biggest fear is they won’t like it and will go away”. “In actuality, our attrition rate was extremely low. the only ones who walked were those that weren’t paying us anyway.”

Accounting Firms are transitioning it piecemeal to stay within most accountant’s comfort zone. Many Accounting firms just don’t feel easy about it and refuse to just jump in and do it. As an Accountant for more than 25 years, I know it works, but very few CPAs feel comfortable making the switch.

So I recommend the next time you’re looking for a new Accountant ask yourself if you want to pay the accountant by the hour or a Fixed Fee? Migrating one step at a time is great for the Miami Accounting Firms, but not for clients. Large CPA Firms like EY and PWC have also adopted Value-Based Pricing as technology reduced the amount of work, and therefore the number of hours they can bill.

What Accountants Knew All Along

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Blog » Accountants in Miami » What Accountants Knew All Along