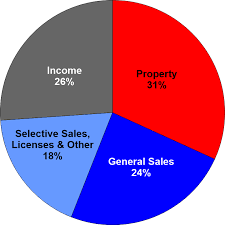

State and Local Taxes

State and Local Taxes are Used for Public Services, Public Schools, and the operation of the state government. Examples are sales tax and real property tax.

Florida Taxes — A Quick Look

Major taxes collected in Florida include State and Local Taxes include sales tax, intangible tax, and corporate income taxes. Information regarding these and additional taxes can be located from the list below. There is no personal income tax in Florida.

- Florida Sales Tax: Florida sales tax rate is 6%.

- Florida State Tax: Florida does not have a state income tax.

- Florida Corporate Income Tax: Corporations that do business and earn income in Florida must file a corporate income tax return (unless they are exempt).

- Florida Property Tax: Florida Property Tax is based on market value as of January 1st that year.

State and Local Taxes in Florida Explained

For decades, Florida has had one of the lowest tax burdens in the country, according to the independent research organization Tax Foundation. For 2013, Florida will place the fifth-lowest tax burden on its residents and businesses. But not all taxes are created equal, and the state collects in a variety of ways that residents need to be aware of.

Income Tax

The strength of Florida’s State and Local Taxes low tax burden comes from its lack of an income tax, making them one of seven such states in the U.S. The state constitution prohibits such a tax, though Floridians still have to pay federal income taxes.

Estate Tax

Florida also does not assess an estate tax or an inheritance tax. No portion of what is willed to an individual goes to the state.

Intangibles Tax

Floridians no longer need to pay taxes to the state on intangible goods, such as investments. The law requiring that tax was repealed in 2007.

Sales Tax

The state charges a 6% tax rate on the sale or rental of goods, with some exceptions such as groceries and medicine. Additionally, counties are able to levy local taxes on top of the state amount, and most do—55 of the 67 Florida counties added local sales tax to the State and Local Taxes in 2012. The highest amount added to the sales tax was 1.5% by 7 counties in 2012, bringing the total sales tax to 7.5% in those counties; that will increase to 8 counties in 2013. For a complete list of the additional sales tax rates by county, visit the Florida Department of Revenue: https://floridarevenue.com/pages/default.aspx

Use Tax

State sales tax needs to be paid for internet or other out-of-state purchases, even if no tax was charged at the time of purchase or were charged at a rate less than the Florida sales and use tax rate. While this includes taxable items bought in Florida, it mostly applies to items bought outside of the state which was brought in or delivered. Florida residents are required to report these sales and pay the use tax on them personally.

Property Tax

Though the state government does not collect any property taxes, local governments receive much of their funding through these taxes. These rates are assessed at the local level and can vary by county, and they are based on the value of the property. Property taxes in Florida are some of the highest in the country, although there are several exemptions to try to lighten the load on some Floridians.

Homestead Exemptions are available on primary residences in Florida. These exemptions can be available up to $50,000. However, only the first $25,000 of this exemption applies to all taxes. The remaining $25,000 only applies to non-school taxes.

Widow(er) Exemptions of $500 are available to widows and widowers who have not remarried. If you were divorced at the time of your ex-spouse’s death, you do not qualify for this exemption.

Senior Citizen Exemptions are available at https://floridarevenue.com/pages/default.aspx certain counties and cities only. They are valued up to $50,000 for residents 65 years old and older who have gross income below $20,000 in 2001 dollars, adjusted for inflation. This exemption is in addition to the Homestead Exemption.

Blind Person Exemptions of $500 are available to Floridians who are legally blind.

Total and Permanent Disability Exemptions are available for homeowners who have a total and permanent disability. Quadriplegics who use their property as a homestead are exempt from all property taxes. Others who must use a wheelchair for mobility or are legally blind and have a gross income below $14,500 in 1991 dollars, adjusted for inflation, can be exempt from all property taxes as well.

Veterans Exemptions exist in a number of different forms.

- A veteran documented as disabled by 10% or more in war or service-connected events can earn an additional exemption of $5,000 on any owned property.

- An honorably discharged veteran who is totally and permanently disabled or requires a wheelchair for mobility due to their service can be exempt from all property taxes. In some circumstances, this benefit can be transferred to a surviving spouse.

- An honorably discharged and disabled veteran who is 65 or older who was a Florida resident when they entered military service may be eligible for an additional exemption. The disability must be permanent and must have been acquired as a result of the military service. The property tax will be discounted based on the percent of the disability.

- Members of the military deployed during the last calendar year can receive exemptions based on the percent of the time during the year they were deployed.

Other Taxes

Florida collects taxes on many other goods and services residents pay for. Documentary Stamp Taxes are assessed on documents that transfer interest in Florida real property, such as warranty deeds and quitclaim deeds. Additional taxes are charged for fuels, tobacco products, communications services, and more. For a full account of taxes charged in Florida, see the Florida Department of Revenue website.

Corporate Income Tax

While individuals do not have to pay income taxes, the same is not true for all types of businesses in Florida. Corporations and artificial entities that conduct business, or earn or receive income in Florida, including out-of-state corporations, must file a Florida corporate income tax return unless exempt. They must file a return even if no tax is due. Sole proprietorships, individuals, estates of decedents, and testamentary trusts are exempted and do not have to file a return. S Corporations are usually exempt as well unless federal income tax is owed. The Florida Corporate Income Tax rate is 5.5%.

For more information about the types of businesses in Florida, click here.

Reemployment Tax (formerly Unemployment Tax)

Eligible businesses must also pay the Reemployment Tax. Formerly called the Unemployment Tax before being renamed in 2012, this tax is used to give partial, temporary income to workers who lose their jobs through no fault of their own, and who are able and available to work.

Make Sure You Assets are Not Over Assessed

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Tax Services » State and Local Taxes