Record Keeping

Record Keeping is Tracking a Company’s Financial Activities. Records are used in official accounting and bookkeeping, especially for businesses.

Why should I keep records?

Good records will help you monitor the progress of your business, prepare your financial statements, identify source of receipts, keep track of deductible expenses, prepare your tax returns, and support items reported on tax returns.

What kinds of records should I keep?

You may choose any system suited to your business that clearly shows your income and expenses. Except in a few cases, the law does not require any special kind of records. However, the business you are in affects the type of records you need to keep for federal tax purposes.

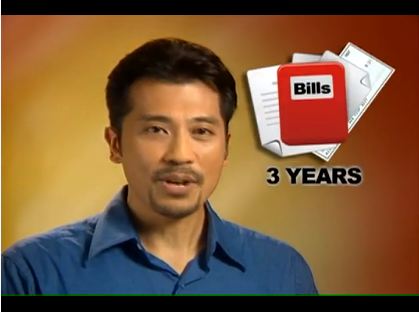

How long should I keep records?

The length of time you should keep a document depends on the action, expense, or even the document records. You must keep your records as long as they may be needed to prove the income or deductions on a tax return.

How long should I keep employment tax records?

You must kept all of your records as long as they may be needed; however, keep all records of employment taxes for at least four years.

How should I record my business transactions?

Purchases, sales, payroll, and other transactions you have in your business generate supporting documents. These documents contain information you need to record in your books.

What is the burden of proof?

The responsibility to prove entries, deductions, and statements made on your tax returns is known as the burden of proof. You must be able to prove (substantiate) certain elements of expenses to deduct them.

References/Related Topics

Publication 583, Starting a Business and Record Keeping

Farm Business Expenses section of Publication 225, Farmer’s Tax Guide

Virtual Small Business Tax Workshop, Lesson 1 – What you need to know about federal taxes and your new business

- Business with Employees

- Operating a Business

Record keeping

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Tax Services » Record Keeping