Surety Bonds The Basics

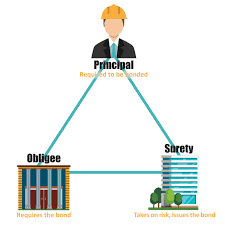

Surety Bonds the Basics is a promise by a guarantor to pay one party (the obligee) if the second party (the principal) fails to meet some obligation.

In financial accounting, a surety bond or guaranty involves a promise by one party to assume responsibility for the debt obligation of a borrower if that borrower defaults. Usually, a surety bond or surety is a promise by a surety or guarantor to pay one party (the obligee) a certain amount if a second party (the principal) fails to meet some obligation, such as fulfilling the terms of a contract. The surety bond protects the obligee against losses resulting from the principal’s failure to meet the obligation. The person or company providing the promise is also known as a “surety” or as a “guarantor”.

Are you worried that your supplier will not deliver the expensive product you paid for? Does your business partner want a guarantee that you will fulfill your contract? If you answered yes to either question, you should consider a surety bond. Surety Bonds the basics is the very premise that a surety bond is a type of insurance that guarantees the performance of a contract. If one party does not fulfill its end of the bargain, then the surety bond provides financial compensation to the other party. To learn more about surety bonds and how to use them in your business transactions, read on.

What is a Surety Bond?

A surety bond is a form of insurance that guarantees contract completion. An obligee (or business) seeks a principal (or contractor) to fulfill a contract. To ensure the obligee a successful delivery, the principal buys a surety bond so the surety company becomes responsible for its obligations. If the principal defaults, the surety company can either find another principal to fulfill the contract or compensate the obligee’s financial losses. In other words, the surety assures a successful contract because it assumes all financial obligations if the principal does not deliver.

Surety Bonds The Basics When Do You Need One?

The main intent behind surety bonds is to ensure contract completion. If you are a business owner who wants to make sure your supplier delivers, then you would request a surety bond to safeguard your investment. If you are a business who provides a product or service, then your customers may request a surety bond to guarantee your delivery. Two common reasons to buy surety bonds are to:

Prevent Steep Losses from a Failed Contract. Surety bonds are especially handy when you are paying for an expensive product or service. In case your principal fails to provide the specified items in the contract, you will not have to worry about finding another principal or losing your money altogether.

Guarantee Your Performance. On the other side, you can use a surety bond to assure your customer a satisfying and prompt delivery. The surety bond builds customer confidence and deters pricey lawsuits because the surety company is shouldering the responsibilities.

Surety bonds are very popular in the construction industry because of the high price tag associated with its products. Businesses want to be sure that construction contractors (or principals) can deliver on their agreements. Other businesses also use them to a smaller extent, to guarantee the successful delivery of products and services.

How Do I Buy a Surety Bond?

You can acquire a surety bond through an independent agent or a surety company. As a small business owner, you can work with the SBA Office of Surety Guarantees to guarantee your surety bond. Note that the Small Business Administration does not issue surety bonds.

Follow these steps to buy a surety bond:

Find an agent or surety company. You can work directly with a surety company or find an agent. An agent has the power of attorney to issue bonds on behalf of a surety. Visit SBA.gov for a list of surety agents and companies.

Submit required forms. If you are acquiring a bond through the SBA, you will need to complete a couple of forms about your personal and business financial status, bank information, and business plan, among others. You can file electronically or by paper application.

Wait for SBA processing. After you submit your forms, SBA goes through a rigorous process to decide whether to approve your application. Your ability to fulfill the contract and your performance capacity are important criteria for winning approval.

What Are the Laws Governing Surety Bonds?

You must buy surety bonds if you are a prime contractor to the federal government running a construction project over $25,000. If you work with a state, county, or city government, you may or may not need surety bonds, so be sure to check with your local government agencies.

Surety Bonds The Basics

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma