Dependents and Standard Deduction

Dependents and Standard Deduction Both Reduce Tax Liability for individuals and mostly all taxpayers are eligible for unless your someone else’s dependent. Please refer to IRS Publication 501 for detailed rules.

What’s New

Who must file? In some cases, the amount of income you can receive before you must file a tax return has increased. Have a thorough talk with your accountant.

Standard deduction increased. The standard deduction for taxpayers who don’t itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2019 than it was for 2018. The amount depends on your filing status. You can use the 2019 Standard Deduction Tables near the end of this publication to figure your standard deduction.

Form 1040-SR. You can file the new Form 1040-SR, U.S Tax Return for Seniors if you are age 65 or over at the end of 2019. The new form generally mirrors Form 1040. Schedules 1 through 3 are used for both Forms 1040 and 1040-SR.

Reminders

Future developments. Information about any future developments affecting Pub. 501 (such as legislation enacted after we release it) will be posted at IRS.gov/Pub501.

Taxpayer identification number for aliens. If you are a non-resident or resident alien and you don’t have and aren’t eligible to get a social security number (SSN), you must apply for an individual taxpayer identification number (ITIN). Your spouse may also need an ITIN if he or she doesn’t have and isn’t eligible to get an SSN. See Form W-7, Application for IRS Individual Taxpayer Identification Number. Also, see Social Security Numbers for Dependents, later.

Introduction

This publication discusses some tax rules that affect every person who may have to file a federal income tax return. It answers some basic questions: who must file, who should file, what filing status to use, and the amount of the standard deduction.

Who Must File explain who must file an income tax return? If you have little or no gross income, reading this section will help you decide if you have to file a return.

Who Should File helps you decide if you should file a return, even if you aren’t required to do so?

Filing Status helps you determine which filing status to use. Filing status is important in determining whether you must file a return and whether you may claim certain deductions and credits. It also helps determine your standard deduction and tax rate.

Dependents explain the difference between a qualifying child and a qualifying relative. Other topics include the social security number requirement for dependents, the rules for multiple support agreements, and the rules for divorced or separated parents.

Standard Deduction gives the rules and dollar amounts for the standard deduction—a benefit for taxpayers who don’t itemize their deductions. This section also discusses the standard deduction for taxpayers who are blind or age 65 or older, as well as special rules that limit the standard deduction available to dependents. In addition, this section helps you decide whether you would be better off taking the standard deduction or itemizing your deductions.

How to Get Tax Help explains how to get tax help from the IRS.

This publication is for U.S. citizens and resident aliens only. If you are a resident alien for the entire year, you must follow the same tax rules that apply to U.S. citizens. The rules to determine if you are a resident or nonresident alien are discussed in chapter 1 of Pub. 519.

Nonresident aliens. If you were a nonresident alien at any time during the year, the rules and tax forms that apply to you may be different from those that apply to U.S. citizens. See Pub. 519.

Who Must File

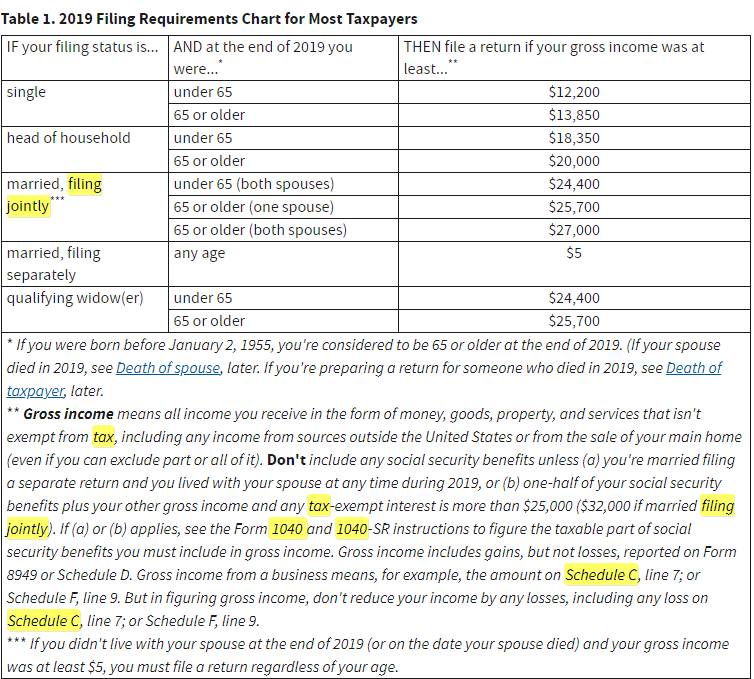

If you are a U.S. citizen or resident alien, whether you must file a federal income tax return depends on your gross income, your filing status, your age, and whether you are a dependent. For details, see Table 1 and Table 2. You must also file if one of the situations described in Table 3 applies. The filing requirements apply even if you owe no tax.

You may have to pay a penalty if you are required to file a return but fail to do so. If you willfully fail to file a return, you may be subject to criminal prosecution.

Gross income. Gross income is all income you receive in the form of money, goods, property, and services that isn’t exempt from tax. If you are married and live with your spouse in a community property state, half of any income defined by state law as community income may be considered yours. For a list of community property states, see Community property states under Married Filing Separately, later.

Self-employed persons. If you are self-employed in a business that provides services (where products aren’t a factor), your gross income from that business is the gross receipts. If you are self-employed in a business involving manufacturing, merchandising, or mining, your gross income from that business is the total sales minus the cost of goods sold. In either case, you must add any income from investments and from incidental or outside operations or sources.

Filing status. Your filing status generally depends on whether you are single or married. Whether you are single or married is determined at the end of your tax year, which is December 31 for most taxpayers. Filing status is discussed in detail, later, in this publication.

Age. Age is a factor in determining if you must file a return only if you are 65 or older at the end of your tax year. For 2019, you are 65 or older if you were born before January 2, 1955.

Filing Requirements for Most Taxpayers

You must file a return if your gross income for the year was at least the amount shown on the appropriate line in Table 1. Dependents should see Table 2 instead.

- Deceased Persons

- You must file an income tax return for a decedent (a person who died) if both of the following are true.

You are the surviving spouse, executor, administrator, or legal representative.

The decedent met the filing requirements described in this publication at the time of his or her death.

Death of spouse. If your spouse died in 2019, read this before using Table 1 or Table 2 to find whether you must file a 2019 return. Consider your spouse to be 65 or older at the end of 2019 only if he or she was 65 or older at the time of death. Even if your spouse was born before January 2, 1955, he or she isn’t considered 65 or older at the end of 2019 unless he or she was 65 or older at the time of death. A person is considered to reach age 65 on the day before his or her 65th birthday.

Example. Your spouse was born on February 14, 1954, and died on February 13, 2019. Your spouse is considered age 65 at the time of death. However, if your spouse died on February 12, 2019, your spouse isn’t considered age 65 at the time of death and is not 65 or older at the end of 2019.

Death of the taxpayer. If you are preparing a return for someone who died in 2019, read this before using Table 1 or Table 2. Consider the taxpayer to be 65 or older at the end of 2019 only if he or she was 65 or older at the time of death. Even if the taxpayer was born before January 2, 1955, he or she isn’t considered 65 or older at the end of 2019 unless he or she was 65 or older at the time of death. A person is considered to reach age 65 on the day before his or her 65th birthday.

U.S. Citizens or Resident Aliens Living Abroad

To determine whether you must file a return, include in your gross income any income you earned or received abroad, including any income you can exclude under the foreign earned income exclusion. For more information on special tax rules that may apply to you, see Pub. 54.

Residents of Puerto Rico

If you are a U.S. citizen and also a bona fide resident of Puerto Rico, you must generally file a U.S. income tax return for any year in which you meet the income requirements. This is in addition to any legal requirement you may have to file an income tax return with Puerto Rico.

If you are a bona fide resident of Puerto Rico for the whole year, your U.S. gross income doesn’t include income from sources within Puerto Rico. It does, however, include any income you received for your services as an employee of the United States or any U.S. agency. If you receive income from Puerto Rican sources that aren’t subject to U.S. tax, you must reduce your standard deduction, which reduces the amount of income you can have before you must file a U.S. income tax return.

Individuals With Income From U.S. Possessions

If you had income from Guam, the Commonwealth of the Northern Mariana Islands, American Samoa, or the U.S. Virgin Islands, special rules may apply when determining whether you must file a U.S. federal income tax return. In addition, you may have to file a return with the individual possession government. See Pub. 570 for more information.

Dependents

A person who is a dependent may still have to file a return. It depends on his or her earned income, unearned income, and gross income. For details, see Table 2. A dependent must also file if one of the situations described in Table 3 applies.

Responsibility of parent. If a dependent child must file an income tax return but can’t file due to age or any other reason, a parent, guardian, or another legally responsible person must file it for the child. If the child can’t sign the return, the parent or guardian must sign the child’s name followed by the words “By (your signature), parent for a minor child.”

Earned income. Earned income includes salaries, wages, professional fees, and other amounts received as pay for work you actually perform. Earned income (only for purposes of filing requirements and the standard deduction) also includes any part of a taxable scholarship. See chapter 1 of Pub. 970 for more information on taxable and nontaxable scholarships.

Child’s earnings. Amounts a child earns by performing services are included in his or her gross income and not the gross income of the parent. This is true even if under local law the child’s parent has the right to the earnings and may actually have received them. But if the child doesn’t pay the tax due on this income, the parent is liable for the tax.

Unearned income. Unearned income includes income such as interest, dividends, and capital gains. Trust distributions of interest, dividends, capital gains, and survivor annuities are also considered unearned income.

Election to report the child’s unearned income on the parent’s return. You may be able to include your child’s interest and dividend income on your tax return. If you do this, your child won’t have to file a return. To make this election, all of the following conditions must be met.

- Your child was under age 19 (or under age 24 if a student) at the end of 2019. (A child born on January 1, 2001, is considered to be age 19 at the end of 2019; you can’t make the election for this child unless the child was a student. Similarly, a child born on January 1, 1996, is considered to be age 24 at the end of 2019; you can’t make the election for this child.)

- Your child had gross income only from interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends).

- The interest and dividend income were less than $11,000.

- Your child is required to file a return for 2019 unless you make this election.

- Your child doesn’t file a joint return for 2019.

- No estimated tax payment was made for 2019 and no 2018 overpayment was applied to 2019 under your child’s name and social security number.

- No federal income tax was withheld from your child’s income under the backup withholding rules.

- You are the parent whose return must be used when making the election to report your child’s unearned income.

Filing Status

You must determine your filing status before you can determine whether you must file a tax return, your standard deduction (discussed later), and your tax. You also use your filing status to determine whether you are eligible to claim certain other deductions and credits.

There are five filing statuses.

- Married Filing Jointly.

- Married Filing Separately.

- Head of Household.

- Qualifying Widow(er).

If more than one filing status applies to you, choose the one that will give you the lowest tax.

Marital Status

In general, your filing status depends on whether you are considered unmarried or married.

Unmarried persons. You are considered unmarried for the whole year if, on the last day of your tax year, you are either:

- Unmarried, or

- Legally separated from your spouse under a divorce or separate maintenance decree.

State law governs whether you are married or legally separated under a divorce or separate maintenance decree.

Divorced persons. If you are divorced under a final decree by the last day of the year, you are considered unmarried for the whole year.

Divorce and remarriage. If you obtain a divorce for the sole purpose of filing tax returns as unmarried individuals, and at the time of divorce you intend to and do, in fact, remarry each other in the next tax year, you and your spouse must file as married individuals in both years.

Annulled marriages. If you obtain a court decree of annulment, which holds that no valid marriage ever existed, you are considered unmarried even if you filed joint returns for earlier years. File amended returns (Form 1040-X) claiming single or head of the household status for all tax years that are affected by the annulment and not closed by the statute of limitations for filing a tax return. Generally, for a credit or refund, you must file Form 1040-X within 3 years (including extensions) after the date you filed your original return or within 2 years after the date, you paid the tax, whichever is later. If you filed your original tax return early (for example, March 1), your return is considered filed on the due date (generally April 15). However, if you had an extension to file (for example, until October 15) but you filed earlier and we received it on July 1, your return is considered filed on July 1.

Head of household or qualifying widow(er). If you are considered unmarried, you may be able to file as head of household or a qualifying widow(er). See Head of Household and Qualifying Widow(er) see if you qualify.

Married persons. If you are considered married, you and your spouse can file a joint return or separate returns.

Considered married. You are considered married for the whole year if, on the last day of your tax year, you and your spouse meet any one of the following tests.

- You are married and living together.

- You are living together in a common-law marriage recognized in the state where you now live or in the state where the common law marriage began.

- You are married and living apart but not legally separated under a decree of divorce or separate maintenance.

- You are separated under an interlocutory (not final) decree of divorce.

Spouse died during the year. If your spouse died during the year, you are considered married for the whole year for filing status purposes. If you didn’t remarry before the end of the tax year, you can file a joint return for yourself and your deceased spouse. For the next 2 years, you may be entitled to the special benefits described, later, under Qualifying Widow(er). If you remarried before the end of the tax year, you can file a joint return with your new spouse. Your deceased spouse’s filing status is married filing separately for that year.

Married persons living apart. If you live apart from your spouse and meet certain tests, you may be able to file as head of household even if you aren’t divorced or legally separated. If you qualify to file as head of household instead of as married filing separately, your standard deduction will be higher. Also, your tax may be lower, and you may be able to claim the earned income credit. See Head of Household, later.

Single

Your filing status is single if you are considered unmarried and you don’t qualify for another filing status. To determine your marital status, see Marital Status, earlier.

Widow(er). Your filing status may be single if you were widowed before January 1, 2019, and didn’t remarry before the end of 2019. You may, however, be able to use another filing status that will give you a lower tax. See Head of Household and Qualifying Widow(er), later, to see if you qualify. On Form 1040 or 1040-SR, show your filing status as single by checking the “Single” box on the Filing Status line at the top of the form. Use the Single column of the Tax Table, or Section A of the Tax Computation Worksheet, to figure your tax.

Married Filing Jointly

You can choose married filing jointly as your filing status if you are considered married and both you and your spouse agree to file a joint return. On a joint return, you and your spouse report your combined income and deduct your combined allowable expenses. You can file a joint return even if one of you had no income or deductions.

If you and your spouse decide to file a joint return, your tax may be lower than your combined tax for the other filing statuses. Also, your standard deduction (if you don’t itemize deductions) may be higher, and you may qualify for tax benefits that don’t apply to other filing statuses.

On Form 1040 or 1040-SR, show your filing status as married filing jointly by checking the “Married filing jointly” box on the Filing Status line at top of the form. Use the Married filing jointly column of the Tax Table, or Section B of the Tax Computation Worksheet, to figure your tax.

Dependents and Standard Deduction

Welcome to the Gutenberg Editor

The goal of this new editor is to make adding rich content to WordPress simple and enjoyable. This whole post is composed of pieces of content—somewhat similar to LEGO bricks—that you can move around and interact with. Move your cursor around and you’ll notice the different blocks light up with outlines and arrows. Press the

How to Increase Profit Margins Through Virtual CFO Services

How to Increase Profit Margins Through Virtual CFO Services

Great Accounting Firms Share These 10 Traits

Great Accounting Firms Share These 10 Traits which has gone far beyond the paper-pushing days and now involves acting as a virtual CFO

Tax Accountant in Miami Cope with IRS Tax Season Delay

Tax Accountant said IRS delays start of tax season for individual returns would be postponed until February 17 with some as late as March

Miami Accountants Philosophy of Up or Out

Its up or out for Miami Accountants firms are faced with the dilemma of keeping long-term managers that are not ready to be equity partners or let them go.

Contadores en Miami Explican Auditorías del IRS

Contadores en Miami, Gustavo A Viera CPA, explica los pasos de una auditoría, desde la notificación de la auditoría hasta el cierre de la misma

Home » Blog » Accountants in Miami » Dependents and Standard Deduction